What Do You Need To Know About Cards?

Sep 07, 2024 By Kelly Walker

What Is a Check Card? A check card, also known as a debit card or a check guarantee card, is a type of payment card that allows customers to make purchases and withdraw cash from their checking or savings accounts. These cards are issued by financial institutions such as banks and credit unions and are accepted by merchants that accept credit cards. They are linked to a customer's checking or savings account and can be used in place of writing a check or carrying cash. The funds for the purchase are transferred from the customer's account to the merchant's account at the time of the transaction. Check cards offer a convenient way to make purchases and withdraw cash without needing cash or a check. They also have security features such as personal identification numbers (PINs) to prevent unauthorized use, and merchants are charged lower fees for check card transactions than credit card transactions. In addition, check cards do not require a credit check, and customers will not accrue any debt from using the card.

Check Card: An Overview

A check card, also known as a debit card or a check guarantee card, is a type of payment card that allows customers to make purchases and withdraw cash from their checking or savings accounts. These cards are issued by financial institutions such as banks and credit unions and are accepted by merchants that accept credit cards. They are linked to a customer's checking or savings account and can be used in place of writing a check or carrying cash. The funds for the purchase are transferred from the customer's account to the merchant's account at the time of the transaction.

Functionality

Check cards can be used to make purchases at retail stores, online, and over the phone. Some check cards can also be used to withdraw cash from ATMs. When making a purchase, the customer swipes or inserts the card into the card reader and enters a personal identification number (PIN) to authorize the transaction. If a signature is required, the customer signs the receipt as they would with a credit card.

Security

Check cards have a security feature called a personal identification number (PIN) used to authorize transactions. This prevents unauthorized use of the card. In case of loss or theft, the customer should report it immediately to the issuer to prevent misuse.

Fees

Check cards have lower fees than credit cards. There are usually no annual fees for check cards, and merchants are charged lower fees for check card transactions than credit card transactions. However, some check cards may charge withdrawal fees at ATMs, which can add up over time. Additionally, if customers use an ATM that is not affiliated with their financial institution, they may be charged additional fees.

Benefits

- Convenience: One of the main benefits of check cards is convenience. They can be used anywhere that accepts credit cards, purchases, and withdraws cash. Additionally, check cards have the added benefit of providing a record of transactions, which can be helpful for budgeting and tracking expenses.

- Lower Fees: Another benefit of check cards is that they have lower fees than credit cards. There are usually no annual fees for check cards, and merchants are charged lower fees for check card transactions than credit card transactions.

- No Credit Check: Unlike credit cards, check cards do not require a credit check. This means customers with poor credit can still apply for and use a check card.

- No Interest Charges: Check cards do not provide a line of credit. Instead, they allow customers to spend money they already have in their checking or savings accounts. This means that customers can only spend what they have in their accounts and will not accrue any debt from using the card.

Drawbacks

- Limited Spending: One of the main drawbacks of check cards is that customers need more money in their checking or savings accounts. The transaction will be declined if a customer needs more money in their account to cover a purchase.

- Fraud Protection: Check cards do not offer the same level of fraud protection as credit cards. If a customer's check card is lost or stolen, the customer may be liable for any unauthorized purchases made with the card.

- ATM Fees: Some check cards may charge fees for withdrawals at ATMs, which can add up over time. Additionally, if customers use an ATM that is not affiliated with their financial institution, they may be charged additional fees.

- Reduced Rewards: Check cards may not offer rewards or cashback programs like credit cards.

Conclusion

In conclusion, check cards, also known as debit cards or check guarantee cards, are payment cards that allow customers to make purchases and withdraw cash from their checking or savings accounts. They offer a convenient and low-cost option for customers who want to use plastic instead of cash or check. However, they also have some limitations, such as being limited to the amount of money in the account and reduced rewards. Customers need to understand the benefits and drawbacks of check cards before deciding to use them as a primary form of payment.

Understanding Mutual Funds and IPOs Investments

What Is a Rebuilt Car Title?

Which Industries Have the Highest Inventory Turnover?

A Comprehensive Guide About Unrestricted Net Assets?

What Do You Need To Know About Cards?

What is Recurring Revenue?

Are Stocks With Low P/E Ratios Always Better?

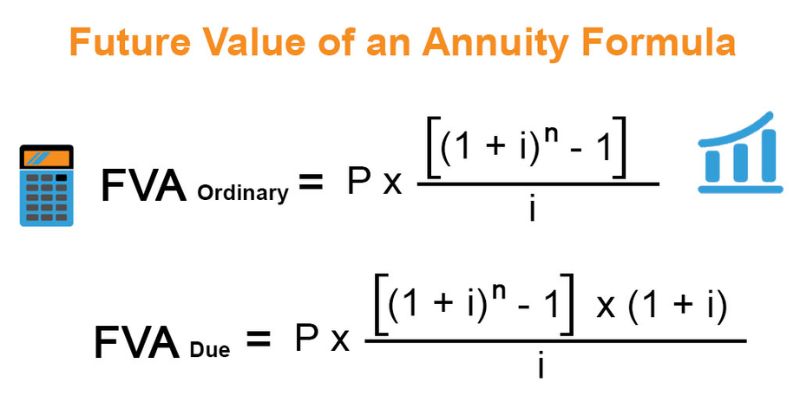

Calculating Present and Future Value of Annuities

What Are General Collateral Financing Trades?