What Is an IPO Lock-Up?

Dec 14, 2024 By Rick Novak

Are you considering investing in an Initial Public Offering (IPO) but don’t know what the term ‘lock-up’ means? Many investors may have heard of this concept before, yet are still unclear on exactly what it entails. An IPO lock-up is a contractual provision that prevents insiders and existing shareholders from selling newly released shares after an IPO.

This protects new investors and provides stability by limiting supply when the stock is first available on the market. We'll dive into what exactly an IPO lock-up looks like, its purpose, and the common length period upon release of company public shares, so if you’ve ever wondered about IPOs or how companies structure them for their benefit.

IPO Lock-Up Period and Its Importance for Investors

An IPO lock-up period is when a company goes public, where its existing shareholders are prohibited from selling their shares. The purpose of this period is to protect investors by ensuring that there is not an immediate flood of stock on the market and depress the share price.

It allows company insiders and others with access to insider information to trade without fear of prosecution for insider trading. It also ensures that new investors can purchase shares at a reasonable price before experienced investors can take advantage of potential inside information or knowledge about the company’s prospects. It helps create a more level playing field for all investors in the IPO process.

Process Behind a Lock-Up Period

When a company decides to go public, it first files an S-1 registration statement with the Securities and Exchange Commission (SEC). This document contains information about the company’s financials, business operations, and other details that investors need to know before investing.

After this has been filed and approved by the SEC, the company can then begin selling its shares in the IPO. During this time, an IPO lock-up period will typically be imposed. This period is usually anywhere from 90 days to one year following the initial offering of stock to protect new shareholders from potential insider trading or market manipulation by existing shareholders.

During this time frame, insiders are prohibited from selling any newly released shares and any shares acquired through a restricted stock unit (RSU) plan.

After the lock-up period has expired, insider shareholders can sell their newly released shares in the market in what is commonly known as a “lock-up expiration.”

This can significantly impact a company's share price as existing shareholders no longer have to worry about being accused of insider trading or other market manipulation activities when selling their shares. It also increases the supply of available shares, which could decrease share prices if there is an oversupply.

Benefits of a lock-up period for companies

- It allows the company to gain more stability and create a better understanding of its financials by providing enough time for investors to properly analyze the stock before making any commitments.

- During the lock-up period, the company’s share price can stabilize since insiders are typically not allowed to sell their shares during this period. This eliminates added volatility if insiders could immediately sell their stock after it went public.

- The lock-up period also ensures that new investors can purchase shares at a reasonable price before experienced investors can take advantage of potential inside information or knowledge about the company’s prospects.

- The lock-up period limits insider trading and market manipulation activities, which can help protect the stock's integrity and provide investors with more confidence when investing.

- It also gives companies more time to prepare for the potential that may arise after going public such as dealing with increased scrutiny from regulators or responding to market conditions.

- The lock-up period creates a sense of trust between the company’s existing shareholders and new investors by allowing both parties to make informed decisions about their investments.

- Companies can better promote their stock during this period since there is less risk of insider trading or other activities that could lead to price manipulation.

- 8. During the lock-up period, companies can use this additional time to ensure all upcoming filings comply with SEC requirements before the shares become available for trading.

- The lock-up period also helps prevent potential lawsuits from disgruntled investors claiming they did not have enough time to evaluate the company’s stock before committing their resources.

- Companies can use this extra time to ensure their business operations are in order so that when the stock becomes available, investors can be confident that it is a sound investment decision.

Overall, a lock-up period can provide many benefits for companies going public as it provides more stability and trust between new and existing shareholders, limits potential insider trading activities, and gives companies additional time to prepare for the challenges of being publicly traded.

Drawbacks of a lock-up period for companies

Although a lock-up period can create many benefits for companies, there are also potential drawbacks.

- The lock-up period limits how quickly insiders and existing shareholders can monetize their shares which could affect executive compensation plans or other incentive programs that involve stock options or restricted stock units (RSUs).

- It can also be difficult to attract new investors as the stock is only available for trading after the expiration of the lock-up period. This can reduce liquidity in the market and make it more challenging for experienced investors to take advantage of price fluctuations caused by news announcements and other events.

- The cost associated with complying with regulations during the lock-up period, such as filing fees and legal costs, may become an added burden for the company, potentially reducing profits.

- During the lock-up period, companies may experience greater scrutiny from regulators or be subject to increased regulations due to any changes in their business operations. This can lead to additional costs and delays that could hurt the company’s performance.

- Companies may have difficulty meeting investor expectations after going public if the stock price does not perform as expected due to unforeseen economic conditions or other factors beyond the company’s control.

FAQS

Do stocks drop after lockup?

Stocks can drop in price after the expiration of a lockup period, as investors may be less likely to purchase the stock due to its limited availability and lack of liquidity. News announcements or economic conditions that come out during the lockup period can also cause a stock’s price to drop.

Can I sell IPO immediately?

No, you cannot sell an IPO immediately after it has gone public. A lock-up period is usually in place for a specified amount of time, preventing insiders and existing shareholders from selling their stock until the lock-up period has expired. Once the lock-up period ends, investors can begin trading the stock on the open market.

What is the average return after IPO?

The average return after an IPO varies depending on the type of stock and market conditions. Generally, stocks offered through IPOs outperform the overall market in the long run, resulting in higher investor returns. However, there is still substantial risk associated with investing in IPOs, as there is no guarantee that a newly public company’s stock will continue to increase in value.

Conclusion

Centering "What Is An IPO Lock-Up?" this blog post has discussed how founders and venture capitalists, who typically own most of a company's shares before going public, are subjected to trading restrictions once their security is publicly traded. Lockup periods generally last up to 180 days and prohibit any insider selling. It is possible for there to be a shorter lockup period, but it's very rare.

Which Industries Have the Highest Inventory Turnover?

What Is a Joint and Survivor Annuity?

What Is Cost-Volume-Profit (CVP) Analysis?

Getting Your Real Estate License

Most Famous Leveraged Buyouts

Are Stocks With Low P/E Ratios Always Better?

What Is a Rebuilt Car Title?

Trinity Debt Management Review

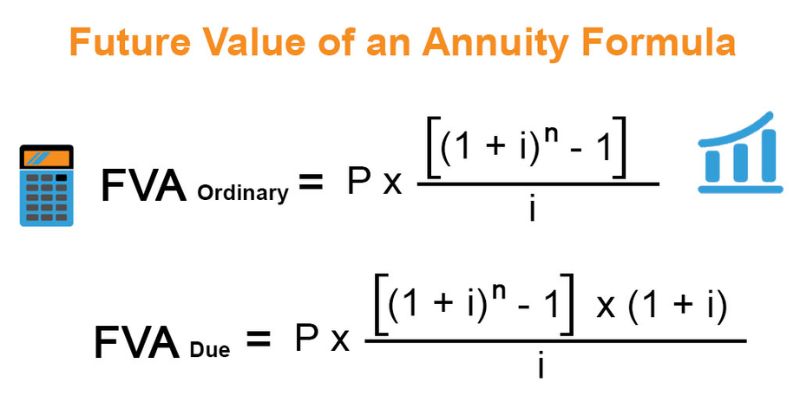

Calculating Present and Future Value of Annuities