Stock Exchanges Around the World

Dec 15, 2024 By Rick Novak

If you’ve ever been curious about exploring different stock exchanges worldwide, you may be surprised to find out how unique and complex each one is. No two exchanges are alike, from market capitalisations and trading hours to national index composition.

In this blog post, we'll look at some of the key features of several global markets and discuss why understanding these nuances can benefit investors looking for international exposure in their portfolios. So grab your passport – it’s time for an exciting journey into economies from across the globe!

Overview of Global Stock Exchanges

Exploring the global stock exchange landscape can be a fascinating journey. From the Tokyo Stock Exchange in Japan to the FTSE 100 index in London, each market is unique and has its own set of rules, regulations and characteristics. Here’s a quick overview of some of the most widely-used exchanges around the world:

- Tokyo Stock Exchange (TSE): The Tokyo Stock Exchange is the largest market in Japan and the third-largest in the world. It has more than 3,500 listed companie,s and its trading hours are from 9 am to 11 pm JST.

- London Stock Exchange (LSE): The London Stock Exchange is the oldest in the world. It's highly diversified and includes over 2,500 international companies from over 70 countries. The LSE trading hours are from 8 am to 4:30 pm GMT daily.

- NASDAQ Stock Exchange (NASDAQ): The NASDAQ Stock Exchange is the second-largest stock exchange in the United States after the New York Stock Exchange. It’s home to over 3,000 companies, and its daily trading hours are from 9:30 am to 4 pm EST.

- Shanghai Stock Exchange (SSE): The Shanghai Stock Exchange is one of China’s largest exchanges and is home to more than 1,000 listed companies. The SSE trading hours are from 9:30 am to 3 pm CST daily.

- New York Stock Exchange (NYSE): The New York Stock Exchange is the largest stock exchange in the United States and one of the oldest in the world. It has more than 2,000 listed companies, and its daily trading hours are from 9:30 am to 4 pm EST.

Types of Stock Exchanges

Regarding stock exchanges around the world, there are a few primary types: major national exchanges, speciality markets, and cross-border trading platforms.

Major national exchanges refer to large stock marketplaces typically associated with each nation’s economy. The New York Stock Exchange (NYSE) in the United States, Toronto Stock Exchange (TSX) in Canada, and the Japan Exchange Group (JPX) are examples of major national exchanges.

These exchanges usually feature a variety of large-cap stocks, as well as some mid-caps and small-caps. Speciality markets focus on particular sectors or industries. For example, the London Stock Exchange (LSE) has several speciality markets, such as the Alternative Investment Market (AIM), which is dedicated to small, emerging companies.

Finally, cross-border trading platforms are digital exchanges enabling investors to buy and sell stocks across national stock exchanges without relying on traditional brokers or market makers. These platforms often make it easier for investors to access international markets, such as foreign stocks or ETFs.

How to Choose a Stock Exchange

When it comes to investing, many factors can influence the success of a portfolio. One of these is where you choose to purchase your stocks. Stock exchanges worldwide have unique features and characteristics which can play a role in determining risk levels, returns and liquidity.

Knowing what to look out for before investing can help you make more informed decisions and maximise the potential of your investments. When assessing stock exchanges, it’s important to consider several key factors.

Market capitalisation is an important metric for determining potential returns on investment, as larger companies tend to have greater stability than smaller ones and are less prone to volatility. Trading hours also vary among stock exchanges, with some offering longer or shorter trading days according to their regional customs.

What You Need to Know About the Major Exchanges

Stock exchanges worldwide are integral components of their respective economies, and understanding how each market works is key for investors looking to gain international exposure in their portfolios.

Let’s look at some of the major stock exchanges around the globe and explore the nuances that make each unique.

Benefits and Challenges of Investing in Foreign Markets

The world of international investing can be both exciting and challenging. While the potential for diversification and financial reward are two major benefits, investors must consider a few risks before taking their portfolios global. Here are some key advantages and disadvantages to bear in mind:

Benefits

- Diversification: Investing in foreign markets can spread risk across different asset classes, sectors and geographies.

- Increased Investment Opportunities: Stock exchanges worldwide offer a variety of investments that may not be available at home.

- Access to Greater Returns: Investing in foreign markets can provide higher returns due to their often higher growth potential and more volatile nature.

Challenges

- Foreign Exchange Risk: Investing in foreign markets comes with currency fluctuation risks, as the value of your investments can be affected by exchange rate changes.

- Regulatory Risk: Regulations vary from country to country and may limit or restrict trading activities.

- Language Barrier: Different languages, customs, and cultures may present communication difficulties.

By understanding the benefits and challenges associated with investing in international markets, investors can make more informed decisions about their portfolios. With the right knowledge and expertise, foreign investments can be a great way to diversify your portfolio and access greater returns.

FAQs

How many stock exchanges are in the world?

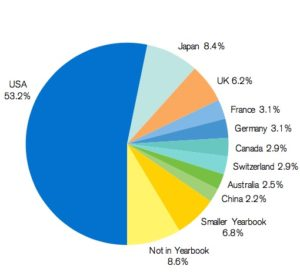

There are currently over 130 stock exchanges worldwide, with the largest in countries like the United States, Japan, China, India, and Germany. However, many smaller exchanges also exist in various other markets.

What is Asia's largest stock exchange?

The Tokyo Stock Exchange (TSE) is the largest stock exchange in Asia and one of the largest exchanges in the world. It is home to over 3,700 listed companies and has a market capitalisation of around 7 trillion US dollars.

What are some key features of global markets?

Global markets vary widely from country to country, and each one has its own unique characteristics. Some key features to consider when looking at global markets include market capitalisation, trading hours, and national index composition. Understanding these nuances can benefit investors seeking international exposure in their portfolios.

Conclusion

The Tokyo Stock Exchange is Asia’s largest stock exchange, with a market capitalisation of over 4.85 trillion USD. It plays an important role in the global economy and provides financial assets to investors worldwide.

It has been the backbone of Japan’s strong economy since 1949, providing millions of people with a wide array of sources of income and opportunities other exchanges may not offer. By utilising world-class infrastructure and market surveillance programs, TSE has gained a reputation for its advanced technology that leads the way for other exchanges worldwide.

Stock Exchanges Around the World

Most Famous Leveraged Buyouts

Total Enterprise Valuation (TEv): Definition, Calculation, Uses

Why Private Banking Might Be the Right Career for You

Trinity Debt Management Review

Deciphering Hedge Funds: Balancing Returns and Fees

What Is Management by Objectives (MBO)?

What Are General Collateral Financing Trades?

Best Short-Term Disability Insurance